Investment Management

Introduction

DIY vs. Delegation

Stepping back and taking your hands off the wheel is hard. A Type-A mentality spreads across all facets of life, from our careers to household management, from the best travel route to what we’re having for dinner.

However, one aspect of our lives is best left untouched and left to professionals: financial and investment management. Do-it-yourself (DIY) investors consistently underperform markets to a shocking degree, risking long-term economic health and retirement. Yet, many still think that the law of averages doesn’t apply to them. This is a mistake – a costly one.

Performance

How Go-It-Alone Investors Perform

People are tricky. Though nearly every retail investor will acknowledge that, on average, individual investment strategies underperform broad investment benchmark indices (like the S&P 500) over a long-term investment cycle, the same active retail investors nearly always think, “Yeah, but not me.”

Most of us can relate to that mindset in some capacity, if not strictly in terms of investment performance. The tendency to overestimate our abilities compared to the average “other” or group collective is called illusory superiority and isn’t a character flaw but a fact of our cognitive heuristics.

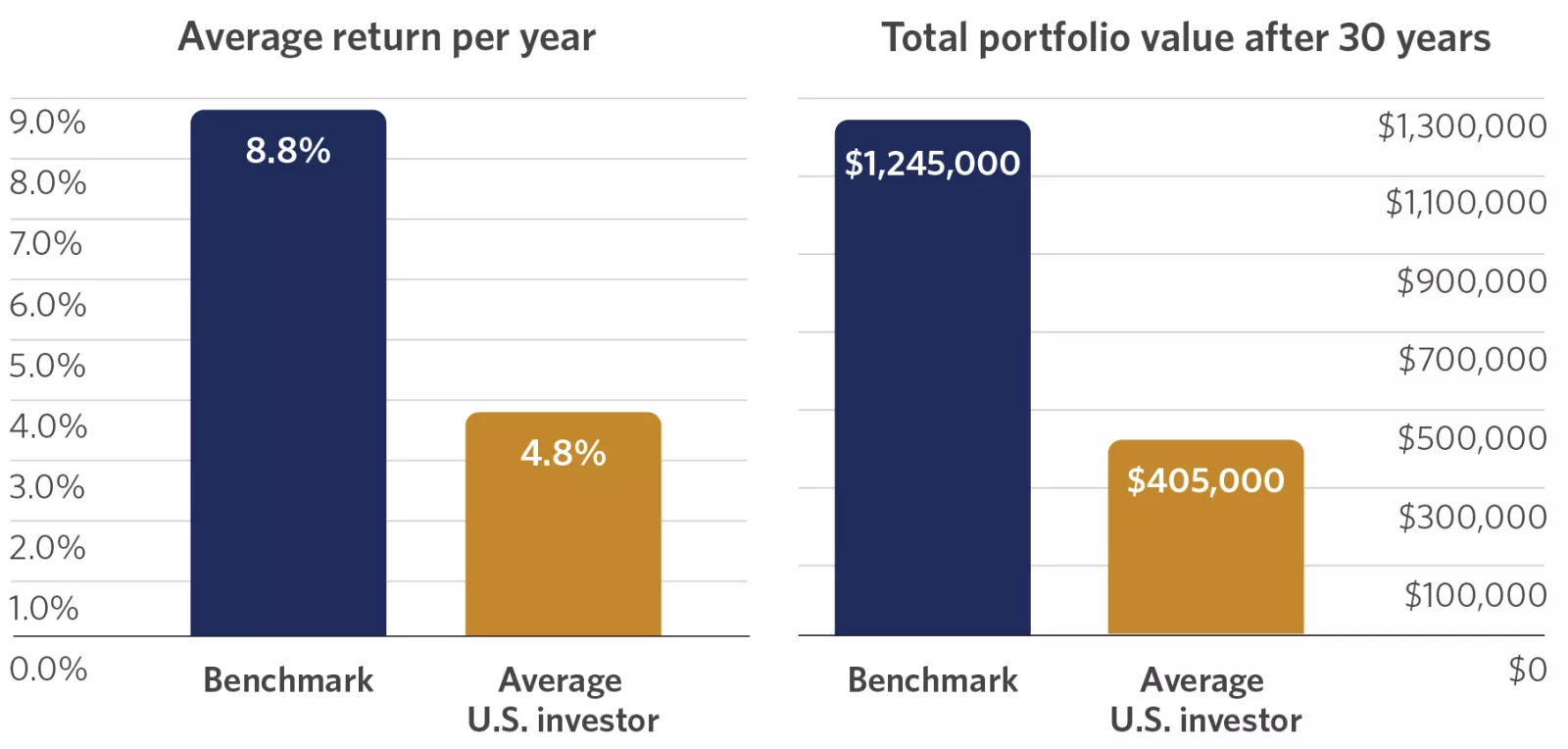

But the data doesn’t lie.

Source: “2022 Quantitative Analysis of Investor Behavior,” DALBAR, Inc. and Edward Jones estimates. Annualized return for the past 30 years ending 12/31/2021. Assumes initial investment of $65,000 in equity and $35,000 in fixed income, rebalanced annually. The equity benchmark is represented by the S&P 500. The fixed-income benchmark is represented by the Barclays Aggregate Bond Index. Returns do not subtract commissions or fees. This study was conducted by an independent third party, DALBAR, Inc., a research firm specializing in financial services. DALBAR is not associated with Edward Jones. Past performance is not a guarantee of future results. Rounded to the nearest $5,000. Indexes are unmanaged and not meant to reflect actual investments.

Challenges with DIY Investing

Active trading

While today’s brokerages and digital accessibility make DIY investing easy and cheap compared to years past, when investors called in trade orders to a broker and often paid steep commission fees, ease of access comes with an apparent downside: the simpler it is to trade and tweak your portfolio, the more likely you are to do so.

Tweaking, fiddling, and adjusting asset allocations without sticking to a plan and long-term strategy is likely the primary reason DIY investors underperform in the long run. This is due, in part, to the disposition effect. The disposition effect describes a common tendency for traders to take profits early and often rather than let “winning stocks” continue to perform while holding on to losing stocks in the hope they’ll soon rebound. In the latter case, it’s closely related to the sunk cost fallacy.

As investing legend Peter Lynch put it, “Selling your winners and holding your losers is like cutting the flowers and watering the weeds.” Unfortunately, we all tend to be very poor gardeners when it comes to DIY investing.

The FOMO Effect

Upset you missed the boat on Nvidia or any other recent example of a high-flying tech stock generating massive gains? Overenthusiasm and exuberance tend to fuel the “FOMO (fear of missing out) Effect” that often sees investors staking substantial cash in a stock at or near all-time highs, only to effectively “buy the top” and never recover.

While it’s impossible to forecast the future accurately – Nvidia may climb another 25% over the next year, or it may crash and burn tomorrow – history is full of examples showing that fearful investors trying to ride a stock bandwagon often end up with portfolios full of poorly-performing companies and, of course, keeping those losing positions intact due to the disposition effect.

The past few years’ GameStop saga is one example, but there are many more. In fact, ask any active retail trader what their worst move was, and it will often be a poorly-timed investment driven by the FOMO Effect.

Signals and noise

Today, there are nearly endless amounts of market and stock news and analysis, driven by mountains of data detailing everything from financial ratios and metrics to local weather effects on stock exchanges.

One would think easier access to data and trading signals would simplify retail trading, but the opposite tends to be the case: instead, many go too deeply into the weeds and end up overcomplicating a strategy in a bid to find the perfect mix of technical and fundamental indicators to predict market moves.

Worse yet, even the experts tend to introduce more noise than signal, whether intentionally or not. For example:

- Hedge fund manager Bill Ackman famously predicted that “hell is coming” to the stock market in March 2020 during the pandemic’s early days. Holding multiple short positions (bets that the market would go down), Ackman made his prediction on CNBC before selling the positions a week later to go long – ultimately pocketing $2.6 billion on the short trade and capturing some of the market’s most significant gains throughout 2020 and 2021. How many DIY traders interpreted Ackman’s noise as a signal to go short and, in turn, missed out on a once-in-a-generation rally?

- Likewise, many thought that a certain segment of stocks would continue climbing indefinitely amid the pandemic, to the point of ignoring basic stock and company operation fundamentals. Though Peloton’s products are great, the company is (and was) operationally incompetent across the spectrum. Investors interpreting massive inflows into Peloton and predicting that its products would continue to be popular post-pandemic could have easily bought shares in the triple-digit range; the stock trades below $5 today.

Diversification (or lack thereof)

Diversification is an easy mantra to chant when strategizing a DIY portfolio, but it takes a lot of work to execute properly. This is due to a range of factors, the simplest being that “proper” diversification – anchored in modern portfolio theory – is highly technical and complex to understand, let alone implement.

Another common blow to diversification is the familiarity bias. This bias describes our tendency to stick with what we know, i.e., a physician may overweight healthcare stocks, or a financial services professional may stick to bank stocks. While there’s a benefit to investing in your area of expertise, it also exposes you to sector risk that, undiversified, can tank your portfolio.

The familiarity bias is even at play at a macro level – most US-based investors tend to stick to US-based stocks, even though international and emerging market diversification reduces overall risk while offering additional upside.

Cost Benefit Analysis

Power of Delegation

To head off a common misconception about hiring and working with a financial professional, the relationship’s value isn’t tied strictly to portfolio performance. While it’s a component, tropes like “Most asset managers can’t even beat the market” take a short-sighted and ultimately myopic approach to value.

That’s because anchoring your conception of a financial professional’s value within an investment performance framework fails to capture the range of opportunities and financial interventions a well-rounded professional offers. In some cases, those interventions are only quantifiable in retrospect – it’s hard, for example, to quantify the benefit of comprehensive estate planning on your family in the event of a worst-case scenario.

Simply put, a financial professional has the access and expertise to open new financial intervention opportunities, some of which (like diversified asset classes and alternative investments) are actually off-limits to retail investors.

CFP®-led advisory teams deliver:

Tax optimization strategy

Tax code is complex, and often, high earners (at least, those not working within financial services themselves) don’t know how to best manage their strategy in a way that reduces total tax paid. These opportunities vary but, beyond standard nuts-and-bolts filings, can include:

- Ideal asset location management: Different assets play by different tax rules, and a financial professional knows the nuanced playbook and how to maximize it to your benefit. From the simplest allocation, such as stacking municipal bonds in a taxable brokerage in place of Certificates of Deposit, to the more complex matters involving overseas incorporation, financial professionals well-versed in asset location management make a huge difference come tax time.

Tax loss harvesting

Some see tax loss harvesting as a “runner-up” prize to realized gains, but advanced strategies pay dividends over an investment cycle by slashing net tax exposure and limiting negative long-term, compounding effects of unrealized gains.

Roth conversions

A key retirement planning strategy for high earners, Roth conversions are complex processes but one that financial professionals execute often.

A Roth conversion helps slash taxes owed in retirement, letting you proactively maximize later-life cash flow and preemptively budget for contingencies or luxuries. As with many maneuvers of this type, doing so is complex, with an entire rulebook dictating the process, creating risk for those going it alone without prior experience.

...and beyond

And more – while offerings vary by financial service provider, most offer a full suite of services you may not realize you need and that, combined, bring enough value to the table to pay for themselves many times over.

When it comes to taxes, you don’t know what you don’t know—but tax law is nuanced and daunting. The price of not knowing can be astronomical, and even minor mistakes can compound rapidly.

Short & long-term planning

A high earner starting their career and one winding it down into retirement have very differential financial and investment needs. However, all too often, self-directed investors learn on the fly (usually by making mistakes) or just revert to “what they’ve always done” with limited adjustment for shifting family, career, lifestyle, and even macroeconomic changes.

In these cases, the benefit of a tenured financial professional is that they’ve done it all before, or, if your case is particularly complex or unique, they have a deep network of other professionals they tap into for advice. In other words, financial professionals learn through iterative practical experience. Though you only retire once, career professionals have helped dozens or even hundreds of people in your same position navigate their entire financial lives.

This also applies to the longest-term planning: estate management and generational transfer. Like tax codes, estate laws are complex and nearly impossible to navigate independently. Likewise, a good financial professional keeps the long game in mind and adapts your estate plans accordingly. In contrast, most young professionals going it alone only consider the need to do so once they start approaching middle age.

Portfolio management

While investment returns are important, they aren’t the only benefit of having a pro in your corner. Professionals leverage their experience to model risks and portfolio allocations based on specific variables more accurately, using data sets that most simply don’t have access to—or know that they exist. At the same time, their network and professional status unlock access to unique asset classes and alternative investments that can help diversify your overall worth and shield against market turbulence.

Even if you’re comfortable playing stock jockey – and have the time to do so – it doesn’t hurt to get a second opinion, and few are as willing and happy to talk shop as top-tier finance professionals.

Value Add

Identifying the Intangibles

While all the above may be tough to assign an objective value to, they’re still at least somewhat quantifiable. What’s often more valuable are a financial professional’s intangible and fringe benefits, which often prove invaluable when considered from a holistic, big-picture perspective. While the intangibles tend to be innumerable, some of the most common benefits of working with a financial professional are:

Emotional support: No, not that kind of emotional support you may be thinking. Financial professionals help mitigate emotion when it comes to money and investments, where they often and understandably run high. By outsourcing investing to a professional, you’re buying an objective, clear, and rational third-party perspective that isn’t tainted by emotional hang-ups we all have about our own money and deviate from your agreed-upon strategy even during periods of market turbulence (which is more than we can say about most self-directed investors!).

Back-office management: Keeping all your ducks in a row admin- and paperwork-wise is a hassle, and the greater your net worth and investment diversity, the greater the difficulty. Even beyond tax docs, which are burdensome, effective investment demands research, periodic review of investor communications and important (and complex SEC filings), and proper data gathering to assess and adjust strategies.

Few people have the time or inclination to stay on top of the obligations required to be objective and clear-minded investors, which brings us to the biggest benefit of hiring a financial professional: you’re buying time.

Takeaways

Your Most Valuable Asset

As a physician, you’re likely familiar with juggling a range of KPIs and organizational objectives. You’re probably a pro at assessing and analyzing:

- Readmission rates.

- Site infection percentages.

- Fall incident rates.

- Medical error percentages.

You’re tracking and sweating over each of these (and more). And when you go it alone as an investor and self-directed financial planner, you’re sweating a slew of additional KPIs, like ROI, price-to-earnings metrics, total yield, and stock betas in your spare time – and maybe even managing down to the level of option Greeks, liquidity ratios, Sharpe ratios, and similarly complex stats.

But none of these investment KPIs measure what truly matters – your time.

Every second spent toiling over your retirement portfolio is a second away from family time, professional development, or continuing education and enjoying your rare moments of personal time. And, in retirement, the same applies but scaled – do you want to sit hunched over your computer tweaking bond ladders and agonizing over single-digit basis points when you could be traveling, partaking in a mission your passionate about or making up for lost family time?

Time is ultimately your core KPI. It is the one asset you can’t claw back. Time invested chasing yield or optimizing allocations is time unspent on activities and quality periods with loved ones or personal hobbies—and few opportunities have as guaranteed a return on investment as buying time back by working with a financial planner rather than going it alone.

If You Do Go It Alone

Of course, you may still decide to chart your own course or even have a small capital allocation you’d like to self-manage for self-development or pure entertainment purposes. If that’s the case, following a few rules of thumb can help you avoid becoming another statistic of retail investors underperforming the market – or worse:

Dollar-cost Averaging (DCA)

Dollar-cost-averaging cash into the market beats opportunistic lump sum allocations over time. As the saying goes, “Time in the market beats timing the market,” and incremental but recurring investments help smooth out long-term volatility.

Index-based investing

Index-based investing beats individual stock investing, but that doesn’t mean you must stick your cash in an S&P 500 ETF and walk away. You can still invest in sectors you’re interested in by finding ETFs and funds tracking those benchmarks, such as a biotech or medical device ETF, to diversify your portfolio and holdings within a specific stock segment. For example, if you’re a big fan of Intuitive Surgical stock, buying the iShares US Medical Device ETF offers exposure to the company while limiting the inherent downside risk of picking individual stocks.

Tax-advantaged accounts

Focus on tax-advantaged accounts first. Though your specific earnings and similar variables dictate what is available, make sure you allocate as much as legally allowed into retirement accounts each year before depositing into a taxable brokerage. Putting money into the market through a tax-advantaged retirement account early and often is the best way to position yourself and your family for long-term financial success.

Net net

Conclusion

Even the smartest DIY investors can’t beat the odds. Even actively trading experts, such as hedge fund managers, consistently underperform broad market indices. Those who do outperform and generate massive gains also have a range of statisticians, computer scientists, tenured mathematicians, and even physicists on their side – tools and talent we simply don’t have access to.

Long-term financial health is more than portfolio management, though a well-rounded asset allocation is important to securing a comfortable retirement and generational wealth. A healthy financial life includes tax strategy, estate planning, and a whole range of intangibles that are impossible to quantify but invaluable when properly leveraged.

However, the biggest drawback to active DIY investing is the sheer time commitment. “Proper” investment management is a job in and of itself – and picking up a second job just to throw money away is a losing proposition.